|

From Accountingnet.ie Recession

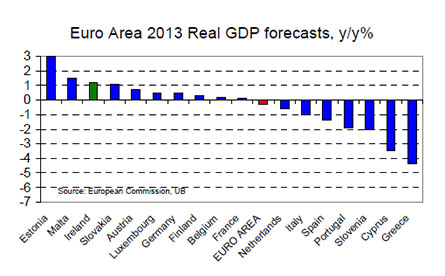

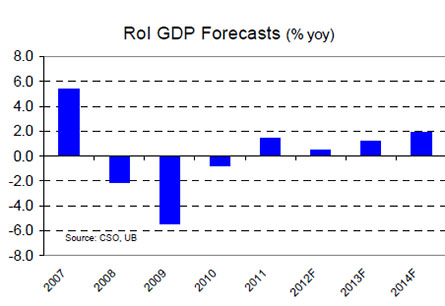

2013 Irish growth forecast revised down as international growth prospects continue to be marked lower We estimate Irish GDP growth was 0.5% in 2012, with the failure to build on the 1.4% recorded in 2011 due primarily to a marked deterioration in growth dynamics in several of Ireland's key trading partners which has translated into weaker, though still positive, Irish export growth. We continue to expect a mild re-acceleration in Irish GDP growth from this year as European economic weakness eases relative to last year. However, we have pared back our projections somewhat to allow for a downgraded international outlook, with 2013 growth expectations for both the euro zone and UK economies having been scaled back by about half a percentage point over the past six months. We now look for Irish GDP growth of 1.2% for this year (1.5% previously), and 1.9% for 2014 (was 2.4%), keeping us on the low side of the prevailing consensus. While still a sluggish outlook, this would still leave Ireland with the third fastest growth rate of the 17 countries in the euro zone for the coming year - highlighting what is, in relative terms at least, a resilient performance. The consistent pattern of downward revisions to growth expectations internationally serves to highlight that the overall balance of risks to the Irish outlook remains tilted to the downside, though there are some upside risks too, including from buoyant FDI flows, past gains in competitiveness and improving domestic demand (see below).

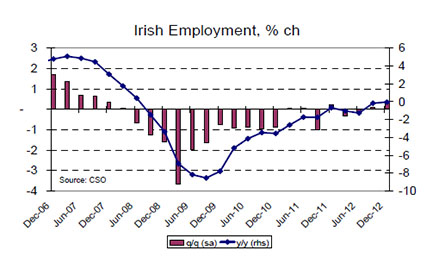

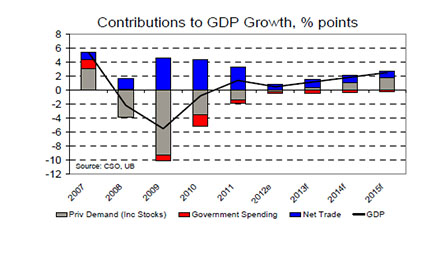

Despite a lower growth forecast the growth mix is improving, with private domestic demand finally showing signs of emerging recovery The two consecutive years of positive, if sluggish, GDP growth notched up over 2011/12 marked the first phase of the Irish recovery as the export sector responded in the expected way to a post-crisis pick-up in global demand. But what has been missing for most of the past two years is evidence of improvement in the broader economy outside the export sector. However, a host of indicators suggest that Ireland's recovery is advancing to a new phase characterised by signs of stability and even some tentative improvement in several parts of the domestic economy. Most notably, recent news on the jobs market has been better than expected. Final quarter 2012 figures show the first back-to-back quarterly gains in employment in over four years, and an ongoing gradual decline in the unemployment rate which now stands at 14.2%, down nearly 1% from the Q1 ‘12 cycle peak (though some of this decline is also linked to a declining labour force). Combined with a resumption of modestly positive average earnings growth, the improved employment trends are helping to support modest gains in aggregate household disposable income. In turn, somewhat better employment and income dynamics have provided important, fundamental support for better-than-expected outcomes in other areas, including retail sales and house prices, both of which showed modest increases in the second half of last year. In addition, the positive trends in some areas of investment we flagged in our last report have been maintained, with growth in non-aircraft machinery & equipment spending accelerating to a seven-year high of 18% in Q3 last year, aided by healthy FDI flows and buoyancy in the agri sector.

Nevertheless, our forecast anticipates that private final demand (the sum of consumer and investment spending) will contribute positively to overall GDP growth in 2013 for the first time since 2007 - which would represent an important milestone in the economy's recovery process. Allowing for some payback linked to special factors, we expect modestly positive growth in overall investment and a return to stability in consumer spending in average annual terms this year. Net exports will still be the main source of growth in 2013 however, and further improvement in the pace and breadth of recovery dynamics into 2014 and beyond remains dependent on the emergence of a somewhat more favourable external environment.

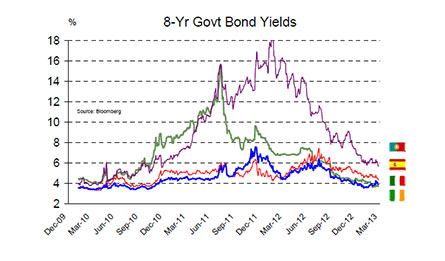

Two years of outperformance relative to fiscal targets, signs of growth resilience, more support from Europe and a healthy funding position underpin a major improvement in investor perceptions of credit worthiness - exit from EU/IMF programme looking more likely Ireland continues to make progress in returning the public finances to sustainability as deficit measures have been lower than EU/IMF quarterly targets for nine consecutive programme review periods. Moreover, it looks as if the overall underlying full-year general government deficit for 2012 could be as low as 7.6% - a full % point lower than the 8.6% ceiling set by Europe, and down from a peak of around 11.5% in 2009. While the deficit clearly remains unsustainably high, that the economy has been able to maintain modestly positive growth rates as well as continue to hit its fiscal targets over the past two years has given investors important reason to re-assess Ireland's credit worthiness. Increasingly positive impressions thereof have also been bolstered by the recent ECB-sanctioned Promissory Note restructuring transaction which generates deficit-improving interest savings, and eases the prospective funding profile. The result has been that long-term bond yields have tumbled to below 4% for the first time since late 2008, from 7.5% as recently as last summer and a crisis high of over 15% in 2011. This dramatic improvement has facilitated a meaningful re- engagement with the capital markets in recent months, with notable developments this year including the €2.5bn of term funding raised in January and the successful sale of the state's interest in Irish Life and its holdings of convertible capital notes in Bank of Ireland (totalling Eur2.3bn). Further term fund-raising of around Eur7.5bn is planned by the authorities for this year. Combined with remaining available programme funding and a sizeable cash buffer (over Eur19bn at end-12), this would leave Ireland's sovereign funding needs fully covered through the end of 2014 and into 2015. High domestic policy credibility, evidence of growth outperformance, helpful assistance from Europe, a stepped-up re- engagement with funding markets and a healthy funding position leave Ireland on track to exit its formal bailout programme at the end of the year. However, as we have emphasised previously, ultimately its ability to do so will depend critically on the state of financial and sovereign debt markets more broadly in Europe. We remain wary of the possibility of a renewed intensification of market tensions in the period ahead, linked to political, economic and policy implementation risks in the euro zone which could scupper Irish plans for a 'clean' bailout exit, possibly requiring some form of additional support such as a precautionary line of credit. In the meantime, speedy implementation of the proposed maturity extensions of Ireland's loans from the EU would play a useful role in enhancing Ireland's chances of an on-schedule exit.

Click here to read the full article Simon Barry John Fahey Ulster Bank Capital Markets © Copyright 2005 by Accountingnet.ie |