From Accountingnet.ie

Law & Regulation

Ireland's Company Act 2014

By PWC

Feb 3, 2015 - 12:39:48 PM

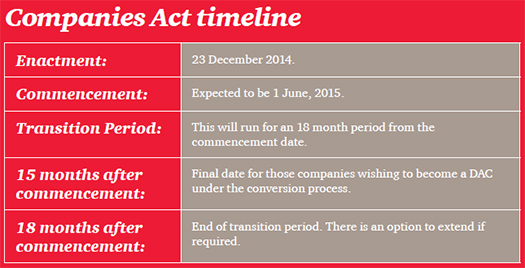

At last, the long awaited Companies Act, 2014 has come into law on 23 December 2014 with commencement likely to be June, 2015. This is the largest piece of legislation lreland has ever seen, comprising a total of 25 Parts (over 1440 sections) and 17 Schedules. The Act consolidates and reforms Irish Company Law and every Company, director and shareholder will be affected and will have choices to make.

In this bulletin we aim to give an overview of the Act, which will assist you to understand, in simple terms, how the Act will affect you. We will look at the options available to you in order to comply with the Act, in a practical and cost effective manner.

New types of entity under the Companies Act 2014

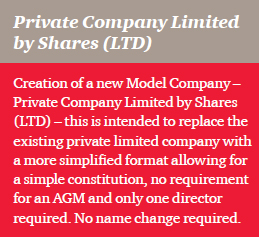

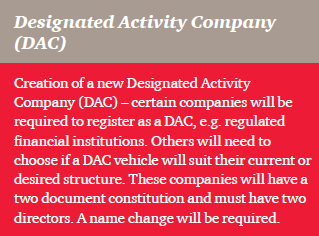

Existing private limited companies will have to make a decision on which of the new entity types they wish to become. They can opt in and become a new private company limited by shares, opt out and become a designated activity company or do nothing and be deemed a designated activity company for the transition and a private company limited by shares thereafter. Please see our other bulletins in which we deal with the options for companies in more detail.

Some of the main differences between the new model private company limited by shares (LTD) and the existing private company limited by shares (EPC’s) are set out below:

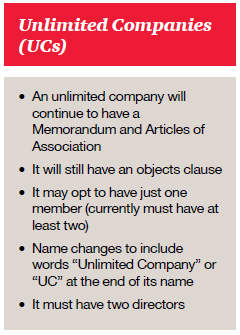

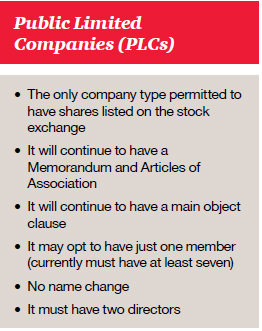

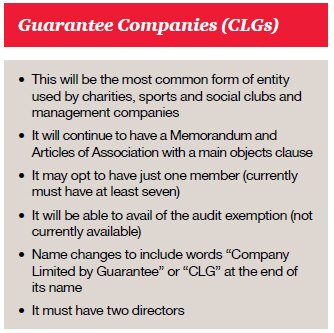

Other types of entity - key features

Other key provisions of the Act

- Directors Compliance Statement – the directors of certain large private limited companies and all public limited companies will be required to produce a compliance statement to be included in the director’s report on the financial statements.

- The Act sets out in one place the provisions relating to the keeping of accounting records, the preparation of financial statements and the audit of financial statements providing additional clarity for directors and companies. In addition this part sets out a clear definition of the financial year end.

- Changes to the requirements relating to directors’ loans – encouraging loans to directors to be properly documented.

- The disclosure of interests in shares and share options has been amended so that de minimis interests of less than 1% are no longer required to be notified.

- The Company Secretary must now have the requisite skills or resources necessary for this role, or access thereto.

- Summary Approval Procedure introduced to simplify the procedure for certain restricted activities such as transactions with directors, financial assistance, capital reductions and solvent

windings up.

- Mergers and Divisions Regime – procedures being introduced to allow to private companies to merge or divide without court approval under the summary approvals procedure resulting in savings, in both time and money, for companies.

- Audit exemption expanded to include group companies and guarantee companies and thresholds expanded.

- Persons Authorised to Bind the Company – options to register individuals authorised to bind the company with the Companies Registration Office.

- Charges and Registration of Charges – priority of registration of charges and a two stage procedure for registration of particulars of charges.

- Formalising the voluntary strike off process and therefore differentiating between voluntary and involuntary strike off.

- Company Law Offences categorised 1 to 4 (1 being the most serious and carrying a maximum fine of EUR500,000 and/or up to a maximum of 10 years in prison).

- Law relating to the winding up of a company updated and now provides more consistency between members voluntary, creditors voluntary and official windings up.

Codification of Directors Duties

In the past determining the duties and responsibilities of the directors has not been clear, now the codification of directors duties in the Act gives clarity for directors. These are set out in

eight fiduciary duties which will apply to directors, shadow directors and de facto directors as follows:

- act in good faith

- act honestly and responsibly

- act in accordance with the company’s constitution and to exercise those powers only for lawful purposes

- not to use company property unless approved by the members or the company constitution

- not to fetter discretion unless permitted by the constitution or unless it’s in the company’s interest

- to avoid conflicts of interest

- to exercise care, skill and diligence and

- to have regard for the interests of members as well as employees

A transition period of 18 months will begin once the Act is commenced. If a company fails to act during the transition period it will be deemed to be a private company limited by shares (post

transition) with a one document constitution consisting of the existing Memorandum and Articles minus the objects clause and any provision which prohibits the alteration of the Memorandum and Articles. What this means in practice is that the publicly filed constitution will not match the actual constitution.

Now is an opportune time for organisations with a large number of companies to review their group structure before the commencement date. Group simplification should be considered to make for an easier transition period. We are happy to help, just give us a call, no question is ever too simple. You need to understand your choices to make the right decision for your company.

Carmel O’Connor

Partner

+353 (1) 792 6417

carmel.oconnor@ie.pwc.com

Ruairí Cosgrove

Director

+353 (1) 792 6070

ruairi.cosgrove@ie.pwc.com

Fiona Barry

Senior Manager

+353 (1) 792 6720

fiona.barry@ie.pwc.com

Trudy Kealy

Senior Manager

+353 (1) 792 6881

trudy.kealy@ie.pwc.com

Edel Dooley

Manager

+353 (1) 792 6466

edel.dooley@ie.pwc.com

Key contacts

© Copyright 2005 by Accountingnet.ie

|